This article delves into the aspects of a white label mobile banking app, from its definition to middle-tier capabilities such as biometric security, scalability, API integration, and KYC approaches that set it apart. The next sections will guide you through the implementation process, including tips on selecting the best banking app development business, the importance of Android and iOS compatibility, and help navigate the complexities of digital banking regulatory regimes. This article aims to provide firms considering installing a white label mobile banking app with a clear road map showing the strategic benefits and operational improvements that this software brings to the financial services sector.

What is a White Label Mobile Banking App?

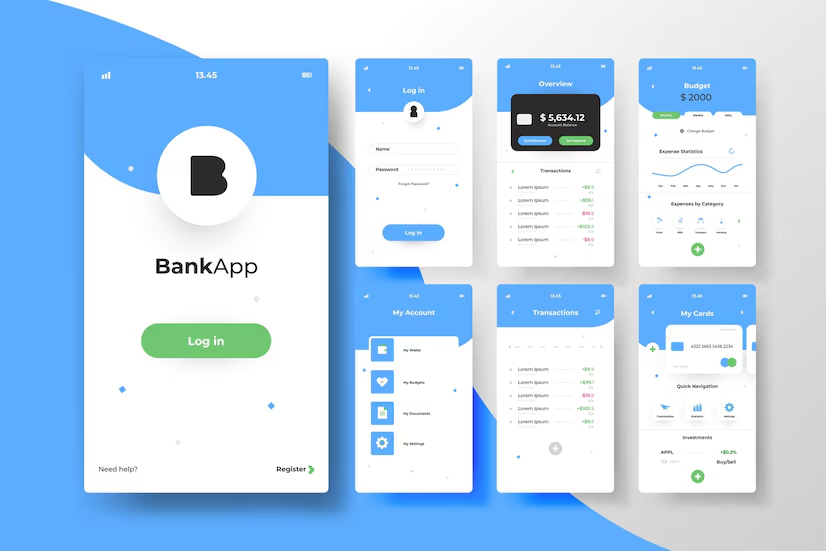

A White Label Mobile Banking App allows businesses to give branded mobile banking services to their clients using a platform established by another company. These programs allow users to perform banking operations on their mobile devices, such as checking balances, viewing transaction histories, and transferring money. This approach saves banks a significant amount of time and money by providing a simple solution that can be customized with their logo.

What is a white-label digital bank?

A white-label digital bank is a financial institution that provides a payment infrastructure to other firms, allowing them to provide financial services under their branding. These banks function as technology suppliers, allowing firms to provide banking services under their brands without having to construct their banking infrastructure.

To put it another way, a white-label digital bank provides a turnkey solution for businesses that want to provide financial services without having to invest in their banking infrastructure. The platform often includes features like as account opening, card issuance, payment processing, and account management.

White-name advanced help purchasers are commonly non-monetary organizations like broadcast communications, fintech new companies, and retailers. They may be able to provide financial services to their customers through a relationship with a white-label digital bank, increasing their product offerings and establishing new revenue streams.

Key Features of White Label Mobile Banking Apps

- Customizability

With so many customization options available, white label mobile banking applications allow businesses to adapt the app with features and branding that are specific to their brand. This flexibility is critical for organizations looking to deliver a cutting-edge mobile banking solution that stands out in a crowded market. The modular nature of these programs allows for the easy implementation of additional features, which improves logo differentiation through personalization.

- Safety and Adherence

White Label Mobile Banking Apps are designed to be dependable and meet the most recent regulatory standards from the start. These apps provide robust security features, biometric authentication, and multi-component authentication to preserve records and ensure compliance with KYC/AML regulations. Frequent updates and monitoring are carried out to comply with changing regulatory requirements, hence lowering.

- User-Friendly Interface

The success of a mobile banking app is largely dependent on its user interface and widespread user base. White Label Mobile Banking Apps are cutting edge, with an emphasis on developing smooth, user-friendly customer interfaces that streamline intricate banking procedures. This entails cutting down on the numerous processes required for routine tasks like managing accounts and transferring funds, as well as making sure the app is user-friendly and accessible to all sixty-four consumers.

- Integration Skills

The flexible platforms on which White Label Mobile Banking Apps are built enable seamless connection with current banking systems and third-birthday party services. The ability to integrate is essential to maintaining a consistent customer experience across many virtual platforms. Furthermore, such applications are made to keep up with the rapid advancements in technology, considering that development never stops.

Considerations for Choosing White-Label Banking Software

When buying white-label banking software, organizations should consider a few factors.

Here are some things to consider:

Operational

The white-label banking software should have the functionality required by the firm, such as payment processing, fraud detection, and account opening and management.

Personalization

The UI and marking of white-name banking programming ought to be configurable to meet the organization’s particular prerequisites and brand personality.

Combination

The integration of white-label banking software with other third-party systems utilized by the organization, such as payment gateways and accounting software, should be straightforward.

Conclusion

Examining the white-label mobile banking app industry reveals that these platforms give a tactical edge to economic zone enterprises by dramatically lowering development time, costs, and complexity. Because of their middle-of-the-road capabilities, such as extreme customizability, strict security measures, user-friendly interfaces, and powerful integration abilities, white-label applications now not only simplify the operational aspects of virtual banking but also beautifully enhance customer engagement and loyalty. Businesses that apply these customizable solutions may better correspond with the shifting expectations of the virtual customer and maintain a competitive advantage in the market.