In recent times, we have observed that Investment Banking is gaining importance. The dynamics of economies are constantly changing, and companies need experts and professionals to cater the needs of stakeholders. Investment Banking as a profession is thus growing, as an investment banker is considered to possess strong finance and analytical skills. What is Investment Banking? Investment banking involves financial transactions for individuals, companies, and governments. An Investment Banker plays a crucial role in managing finances, conducting capital operations, and facilitating economic growth. In simpler terms, Investment Bankers handle important financial transactions for large firms, manage their portfolio, and do investments for clients The Daily Mirror.

Why Investment Banking is a skill-full profession

As an investment banker you are well-trained in skills such as financial analysis, Valuation, Business analysis, etc. Investment banking has a promising future. Let’s understand that why Investment banking does not only offer a lucrative career but makes you a skill-packed individual who are experts in the following fields: –

- Investments Bankers assist companies in raising capital, they help businesses access the capital market effectively. They help facilitate IPO’s (Initial public Offerings), issuing bonds, or funding through other sources.

- Investment bankers are expert in Client dealings and negotiations. They provide strategic advice and negotiate deals to ensure successful outcomes.

- These professionals analyse market trends, assess risks, and provide financial advice to clients, helping companies make informed decisions regarding financial management and growth strategies.

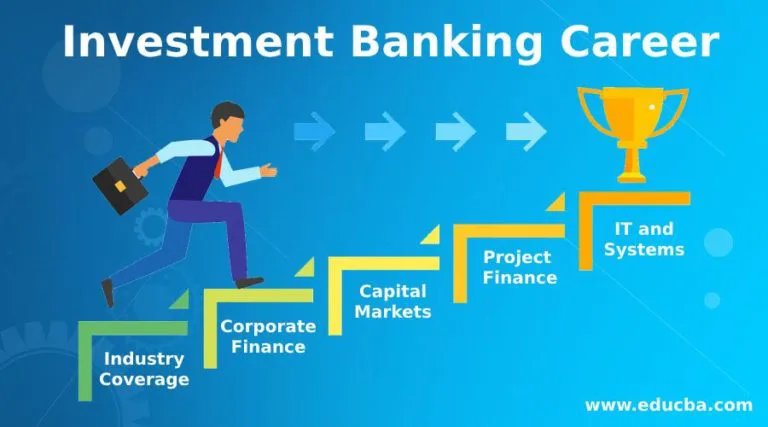

Career Opportunities as Investment Banking

If you are interested in career as an investment banker, the let’s explore some roles and job profiles you can look for:

- You can consider being an Investment Banking Analyst, this is generally the entry level position for an investment banker, after gaining experience you will be promoted as senior analyst. You will be offered a minimum CTC of 6 lakhs to 10 lakhs, which could grow significantly with years of experience.

- JP Morgan Chase & Co. and several other reputable companies such as Goldman Sachs hire investment bankers for jobs of a financial planner, Portfolio Analyst, etc.

- Morgan Stanley is another major MNC hiring investment bankers, they provide opportunities for investment bankers to work on complex transactions and financial advisory services,

- Other hiring companies are JP Morgan, Citigroup, Bank of America Merrill Lynch, they have a strong investment banking division hiring investment bankers for services related to mergers and acquisition(M&A), advisory services, and capital raising.

Eligibility for Investment Banking:

- As far as the educational background is concerned, you must have completed your bachelor’s degree. It will be beneficial if the relevant degree is obtained in finance, economics, or a related field.

- If you are an undergraduate, then you must have passed your class 12th preferably in commerce degree, then you are eligible to enter in top investment banking colleges in India such as NMIMS, St. Joseph’s College of Commerce, Christ University, Annamalai University.

How to become an Investment Banker?

There are multiple ways to pursue Investment Banking. You can pursue Investment banking through various routes, some of the top investment banking course and classes in India are stated below along with their eligibility criteria:

- Certificate Courses: These short-term programs cover specific topics related to investment banking. They typically last around 1 month to 6 months. For certificate courses, a candidate with 50% marks in 10+2 can apply.

- Diploma Courses: Diploma programs provide more in-depth knowledge and usually last 6 months to 1 year. Various Indian institutes that offer other relevant diploma courses in banking and finance such as Leverage Edu that provides study abroad counselling and offers investment banking courses. Diploma courses require 50% marks in class 12th from any background.

- Undergraduate Courses: These are full-time degree programs (such as BBA or B.Com) with a specialization in investment banking. If you are an undergraduate, then you must have passed your class 12th preferably in commerce degree, then you are eligible to enter in top investment banking colleges in India such as NMIMS, St. Joseph’s College of Commerce, Christ University, Annamalai University. UG courses typically require 50% marks in 10+2, preferably from a commerce background.

- Postgraduate Courses: Postgraduate degrees (like MBA or PGDM) often include investment banking as a specialization. Postgraduate courses demand graduation from a relevant stream with 50% marks.

Investment Banking Future and Career

- Investment Banker’s job is a creative job, it challenges you to find creative solutions to complex problems.

- Investment Banking is considered as a prestigious title due to its association with high-profile deals and influential clients.

- This field of work provides you with global opportunities, as you gain exposure to work in different markets and cultures. You will get to work in a dynamic environment, and you do not have to do any mind-numbing jobs.

- Investment banking as a professional career choice is a worthy choice as its financial rewards are highly lucrative. Professionals often receive substantial bonuses based on performance. Alongside, this course hones skills like financial modelling, valuation, and negotiation tactics. These skills develop your individual personalities and offer you advantage in the long run when you might want to freelance and start your own business.

Investment banking as a professional choice, not only is the opportunity to win in the corporate world or get a high-paying job but along with it also helps you grow and sharpen your skill as an individual. So, while you make a decision about your future, you can certainly leverage Investment banking as a successful career option.